Backed by MakerDAO, Centrifuge rises to become the leader in on-chain credit. Learn about the RWA underlying service provider

Author: Scof, ChainCatcher

In the past six months, MakerDAO, which has benefited from RWA, has been steadily investing in RWA assets, increasing its holdings by $100 million in just one week last month, currently owning over $3.3 billion in RWA assets.

As the underlying technology service provider for MakerDAO's expansion into RWA assets, Centrifuge has successfully leveraged this opportunity to "reverse" its fortunes, becoming the largest on-chain credit protocol by active loan amount. According to data from the RWA.xyz platform, Centrifuge's active loan amount was approximately $84 million on January 1, 2023, and has since grown to over $240 million, a growth of 286%, far surpassing former credit leaders Maple and TrueFi.

According to the crypto data platform RootData, Centrifuge has completed four rounds of financing, raising a total of $15.8 million, with investors including Coinbase Ventures, IOSG Ventures, and others.

Despite gaining favor from top DeFi players like MakerDAO and well-known investment institutions, Centrifuge, like former leaders Maple and TrueFi, cannot avoid defaults and bad debts. Earlier this year, it was reported that approximately $5.8 million in loans from two lending pools had defaulted, and in August, there were claims from the community that impending defaults would put MakerDAO's $1.84 million investment at risk of loss. According to RWA.xyz, Centrifuge currently has accumulated over $15.5 million in unpaid loans. The MakerDAO community even proposed to stop providing loans to the tokenized credit pools on Centrifuge.

As the fastest-growing on-chain credit protocol this year, how does Centrifuge operate? What mechanisms are in place to handle the controversial defaults and bad debts?

RWA Becomes a Lifeline for On-Chain Credit, Centrifuge Rises to Dominance

In addition to on-chain US Treasury bonds, on-chain lending has also played a significant role in boosting the RWA sector, with familiar names like MakerDAO, Compound, Frax, and Aave all making moves. Beyond these established DeFi protocols, some on-chain credit protocols have also benefited from the RWA narrative. According to RWA.xyz data, on-chain lending increased by over $200 million from January 1 to September 30, growing by over 80%.

However, despite this, the development of credit in the crypto space is just beginning compared to the significant share of credit loans in traditional financial markets. Around the end of 2021, institutional on-chain credit protocols represented by TrueFi and Maple began to emerge. Unlike the over-collateralized lending models of traditional DeFi like Compound and Aave (which lend one type of asset by over-collateralizing another), they primarily provide low or even no-collateral lending services to crypto-native trading firms and market makers. However, institutions applying for loans need to submit information for credit assessment, such as monthly reports including balance sheets and annual independent audit financial statements. Even on Maple, borrowers must register with the credit risk data platform Credora, which provides lenders with real-time information to help assess the risk levels accumulated by borrowers on different cryptocurrency exchanges.

The low or no-collateral credit lending model has attracted many institutional clients, such as Alameda Research, Wintermute, and BlockTower. By mid-2022, Maple's active loans on the Ethereum chain reached nearly $1 billion, while TrueFi peaked at nearly $500 million. Goldfinch, which had active loans just behind Maple and TrueFi, raised $37 million in three rounds of financing from large crypto venture funds like a16z and Coinbase Ventures, as well as angel investors like Balaji Srinivasan, Ryan Selkis, and Tarun Chitra.

However, as the crypto market entered a deep bear phase, overall liquidity in DeFi diminished, and CeFi faced a wave of defaults, leading institutional lending protocols like Maple and TrueFi to suffer significant defaults and bad debts. For example, after the collapse of Terra and Three Arrows Capital in June last year, Maple Finance officially stated that it might face short-term liquidity challenges and cash shortages after the crypto lending company Babel Finance went bankrupt and defaulted on a $10 million loan.

With the collapse of FTX, Maple Finance indeed faced larger-scale bad debts. Maple Finance's borrower Orthogonal Trading previously misreported its exposure to FTX and was unable to repay the unpaid loans in the M11 credit pool due on December 4, 2022, resulting in a default amount of $36 million. Multiple institutions, including Nexus Mutual and Sherlock, had funds deposited in Maple Finance's lending pool affected. Coincidentally, TrueFi also suffered from a default by BlockWater. By the end of 2022, both Maple Finance and TrueFi had significantly dropped to around $20 million.

By 2023, with the rise of the RWA narrative, the on-chain lending sector has seen a turnaround, and the market landscape has changed significantly. In addition to the previously leading lending protocols like Maple, which are seeing a recovery in active loan amounts, on-chain credit protocols like Centrifuge, which have remained low-key, are experiencing rapid growth, surpassing Maple to become the new leader in the credit space. Goldfinch, favored by many well-known investors from a16z, has maintained steady development without significant growth or decline.

Previously impacted by the no-collateral credit model, Maple expanded this year to include a lending model backed by real assets and an over-collateralization model. Additionally, Maple launched an on-chain US Treasury bond lending pool in April this year, restarted its lending pool on Solana, and launched on the Base network. During this period, Maple completed a $5 million financing round in August. Currently, Maple's active loans have increased from over $20 million at the beginning of the year to nearly $100 million.

In contrast to Maple, Centrifuge, which has been dedicated to real-world asset-backed lending from the start, has seen even more significant growth. Currently, Centrifuge's active loans have grown to over $240 million, nearly tripling since the beginning of the year, making it the largest on-chain credit loan protocol.

MakerDAO Boosts Centrifuge to Become the New Leader in On-Chain Credit

Centrifuge is actually an early on-chain lending protocol, established in 2017. Unlike credit protocols like Maple and TrueFi, which are more focused on crypto financial institutions, Centrifuge emphasizes lending against traditional real-world assets, making it one of the earliest players in the RWA space.

As early as 2020, Centrifuge, as a technology service provider, helped MakerDAO build an RWA vault backed by real estate development loans from 6s Capital. This year's rapid growth in Centrifuge's on-chain active loans is primarily attributed to MakerDAO's investment in RWA assets.

Among the six lending pools disclosed on Centrifuge's official website, eight are related to MakerDAO. For example, the New Silver series, which invests in real estate bridge loans, the BlockTower series, which invests in structured credit, and the Harbor Trade Credit series, which is based on accounts receivable lending, all have MakerDAO as a priority investor in the pools. (Details on Centrifuge's tiered investment mechanism will be discussed later). Statistics show that the funds related to MakerDAO currently total about $200 million, accounting for 80% of Centrifuge's total TVL (approximately $250 million).

From the MakerDAO asset list statistics, the BlockTower S3 and BlockTower S4 vaults integrated with Centrifuge were both established this year, currently providing $70 million and $56 million in DAI supply, respectively. This means that MakerDAO has provided at least $120 million in loan funding support to Centrifuge this year.

Currently, the APR of the funds pools related to MakerDAO ranges from 4% to 15%, mostly higher than the average APR of 4% in DeFi.

In addition to MakerDAO, Centrifuge also became a technical service provider for Aave's investment in RWA assets as early as 2021. Aave and Centrifuge jointly established a lending pool dedicated to RWA, which operates independently from the Aave lending market, with a current fund size of approximately $5.5 million.

Compared to MakerDAO, Aave's investment scale in RWA assets through Centrifuge is still relatively small. However, as the RWA narrative continues to gain traction, Aave is also looking to increase its investment in RWA assets this year. In August, Aave passed a proposal to collaborate with Centrifuge Prime to invest in US Treasury bonds, with an initial investment of $1 million USDC, aiming to increase the investment amount to 20% of its stablecoin holdings. Perhaps Aave's continued investment in RWA will bring a new wave of growth to Centrifuge.

How Does Centrifuge Achieve Real Asset-Backed Lending? What is the Default Risk Mechanism?

As the preferred RWA technology service provider for established DeFi protocols like MakerDAO and Aave, what problems does Centrifuge solve, and how does it operate?

In general, Centrifuge, as a lending platform, primarily connects two parties: one is the funding party looking to earn returns through lending, mainly consisting of some DeFi protocols in the crypto space, such as MakerDAO and Aave; the other is the borrowing party seeking financing, typically startups or organizations that own real-world assets like real estate, accounts receivable, and invoices. To facilitate the flow of assets between the real world and DeFi, Centrifuge needs to provide legal support and asset tokenization on-chain.

Due to the complexity of the entire process, which involves both on-chain and off-chain worlds, the workflow can be complicated. We will use one of Centrifuge's lending pools, called New Silver Series 2, as an example to analyze the entire operational process.

The New Silver Series 2 lending pool is initiated by New Silver as the asset issuer, providing financing for a portfolio of real estate bridge loans, which are offered to real estate developers for a term of 12 to 24 months. New Silver, established in 2018, is a non-bank lending institution primarily providing bridge loans to the real estate industry to help borrowers cover the costs of purchasing new properties before selling existing ones.

As the asset demand party, New Silver first needs to initiate a Pool Entry Proposal (POP) on the Centrifuge forum, clearly stating what it does, its credit situation, and the purpose of the funds, etc. (However, the currently public POPs on the forum seem incomplete, as the proposal for the New Silver Series 2 pool is not visible.)

The submitted Pool Entry Proposal (POP) will enter the due diligence phase, where a third party conducts risk assessments and legal reviews, forming an analysis report. After the assessment is completed, it enters the final discussion phase, where Centrifuge's credit risk group and CFG token holders vote on the entry.

Once successfully selected, the asset issuer and investors need to initiate the process based on Centrifuge's off-chain legal risk framework and on-chain asset tokenization.

Off-chain, the asset issuer New Silver needs to establish a Special Purpose Vehicle (SPV) to serve as the entity for this financing, separating the assets to be collateralized from the company's other assets. Additionally, a third-party professional team is needed for asset valuation, auditing, and trust services to further enhance security. The borrower signs a financing agreement with the SPV.

Source: @defi_drag

Source: @defi_drag

For investors, Centrifuge needs to conduct KYC and anti-money laundering checks, currently primarily partnering with Securitize to complete this. Additionally, investors need to sign a subscription agreement with the SPV established by New Silver.

On-chain, the first step is to put data on-chain. Based on Centrifuge's P2P messaging protocol, the asset issuer New Silver can store all off-chain data related to real assets on the Centrifuge Chain. This chain is developed based on the Substrate framework, capable of sharing the security of the Polkadot network, and has been bridged to Ethereum. New Silver can package the data into NFTs on the Centrifuge Chain and use them as collateral to initiate the lending mechanism in Centrifuge's Tinlake lending pool (on the Ethereum chain), borrowing stablecoins provided by investors.

So how can investors participate in investments in the Tinlake lending pool? What is the default risk mechanism? Centrifuge has implemented a risk tiering system, issuing two different risk and return ERC20 tokens, DROP and TIN, for investors with different risk preferences to subscribe.

Investors need to purchase DROP and TIN tokens with DAI. Holding DROP tokens gives priority in profit distribution from the asset pool, enjoying a fixed interest rate; in the event of risks (such as loan defaults), they bear losses last, typically having lower risk and lower returns. For example, holders of New Silver's DROP tokens enjoy a fixed interest rate of 7%. Holding TIN tokens means they receive profit distribution last, with a floating interest rate, but they must bear losses first, typically having higher returns and risks.

More specifically, suppose the asset issuer/borrower borrows $1 million, and the holders of DROP and TIN tokens provide 20% and 80% of the funding, respectively. The asset issuer/borrower needs to pay 10% interest. DROP tokens are entitled to a fixed interest rate of 5%.

Ultimately, if they only repay $600,000 at maturity, the DROP tokens will first receive the principal of $200,000 and $10,000 in interest at the 5% rate. Of the repaid funds, $390,000 remains for TIN token holders to share, but they originally invested $800,000 and can only recover part of their principal.

However, if the holders of DROP and TIN tokens provide 80% and 20% of the funding, respectively, and the asset issuer does not default, under the same conditions, the DROP tokens will receive $800,000 in principal and $40,000 in interest, while TIN token holders will receive $200,000 in principal and $50,000 in interest, with an interest rate as high as 25%, far exceeding the 5% fixed rate for DROP token holders. Therefore, for investors, they can choose between DROP and TIN tokens to achieve risk and return hedging.

In addition to tiering risk and return, Centrifuge's funding pools are cyclical, allowing for investments and redemptions at any time, but ensuring that DROP tokens are redeemed before TIN tokens, and that TIN tokens do not fall below a set minimum ratio. When the asset issuer repays the financing amount and interest at maturity, the pledged NFTs will also be returned.

Centrifuge Aims to Become RWA Infrastructure

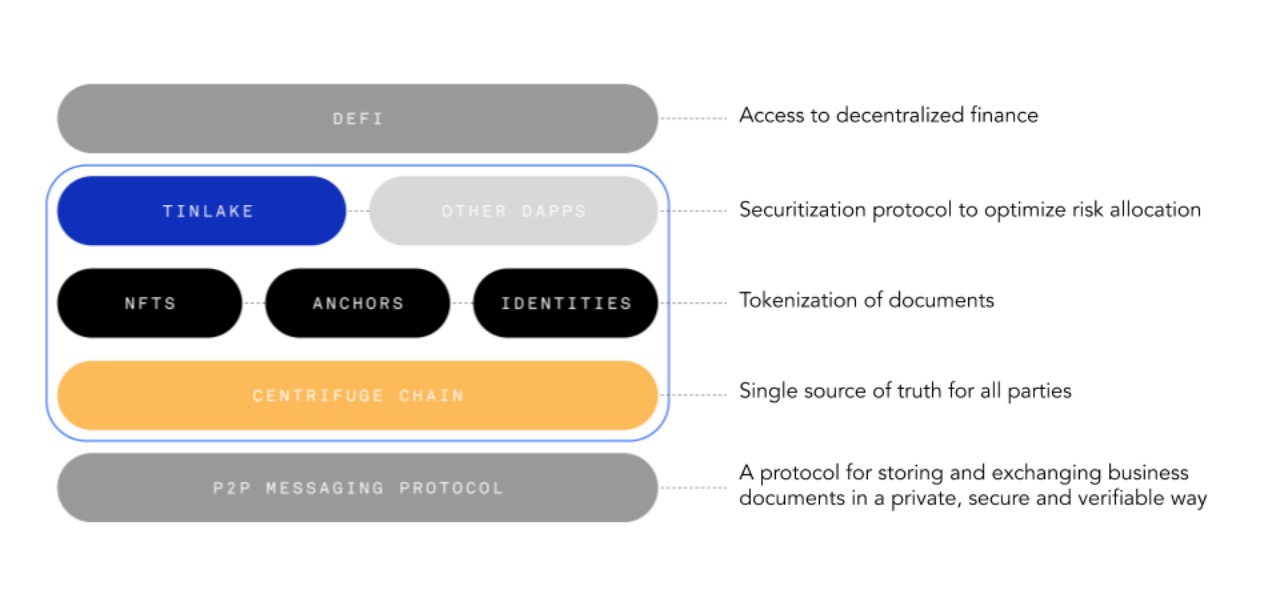

Overall, Centrifuge, as a platform bridging DeFi and real-world assets, has several core products and components in its ecosystem.

First is the Tinlake protocol, a lending platform aimed at C-end users, currently deployed on Ethereum, which converts real-world assets into ERC-20 tokens and provides access to decentralized lending protocols. Tinlake charges a service fee of 4% of the total supply from each lending pool.

Second is the Centrifuge P2P messaging protocol, which allows collaborators to securely and privately create, exchange, and verify asset data, and tokenize assets into NFTs.

Third is the Centrifuge Chain, developed based on the Substrate framework, capable of sharing the security of the Polkadot network, and has been bridged to Ethereum. Currently, asset issuers primarily create NFTs from real assets on the Centrifuge Chain.

Centrifuge Chain also has its native token CFG, which is mainly used to incentivize network and ecosystem development, as well as community governance. CFG can also be bridged to Ethereum and used as an ERC20 token.

CFG is primarily used to pay transaction fees on the Centrifuge Chain; as a node incentive to maintain the security of the Centrifuge Chain network and stake CFG to gain financing qualifications and participate in governance. Since the Tinlake protocol is currently mainly on the Ethereum chain rather than the Centrifuge Chain, the use cases and value capture ability of CFG are limited. However, this year, backed by MakerDAO, the growth of on-chain active loans has been impressive, and its token performance has also seen growth. According to CMC data, the current price of CFG is $0.54, up more than three times from around $0.15 at the beginning of the year, although it still has a significant gap compared to the record of over $2 during the 2021 bull market.

Regarding the use of CFG, in March 2022, Centrifuge announced a roadmap to launch and expand real-world asset pools on the Centrifuge Chain, replacing the Tinlake protocol on Ethereum, and expanding the use cases for CFG, including fee mechanisms and staking mechanisms. However, the migration of the Tinlake protocol has not yet been completed.

As the demand for RWA in the crypto space grows, Centrifuge is also updating some products and expanding some businesses this year, aiming to become the infrastructure for RWA. The Tinlake lending application announced a new round of upgrades in May this year. In addition to improvements in user interface and KYC experience, it has also expanded integrations with multiple public chains and wallets. Additionally, in July this year, a lending credit group was established, composed of experts from the finance and lending sectors, to review and assess the risks of Centrifuge's lending pools.

Furthermore, in June this year, Centrifuge announced the launch of the RWA infrastructure product Centrifuge Prime, which primarily provides a full suite of legal frameworks and technical services for DAOs and DeFi protocols to bridge real-world assets and bring them on-chain. In August, Aave passed a proposal to collaborate with Centrifuge Prime to invest in US Treasury bonds.

However, despite gaining favor from top DeFi protocols like MakerDAO and Aave, Centrifuge, like former on-chain protocols Maple and TrueFi, cannot avoid defaults and bad debts. This year, Centrifuge has continuously faced reports of defaults, with over $15.5 million in unpaid loans accumulated. In August, there were also claims from the community that impending defaults would put MakerDAO's $1.84 million investment at risk of loss. The MakerDAO community even proposed to stop providing loans to the tokenized credit pools on Centrifuge.

Compared to the risks on-chain, the off-chain review and assessment of asset issuers/borrowers and liquidation may pose significant challenges. In the traditional financial world of credit, past P2P lending has caused considerable harm to many investors and even the financial industry. In attempting to lower the financing threshold for small and medium-sized enterprises and organizations in the real world, how on-chain credit protocols avoid being exploited by wrongdoers and establish investor protection mechanisms through legal and technical means may be a long and arduous journey.