Betting on the Future: Predictions for the Crypto Boom in 2025

In this uncertain world --- --- from geopolitical tensions to breakthroughs in artificial intelligence --- --- imagine a market where you can directly bet on the future. This is not casino-style gambling, but a highly complex system that uses collective intelligence to predict the future with astonishing accuracy. Welcome to the prediction market, the "crystal ball" of modern society.

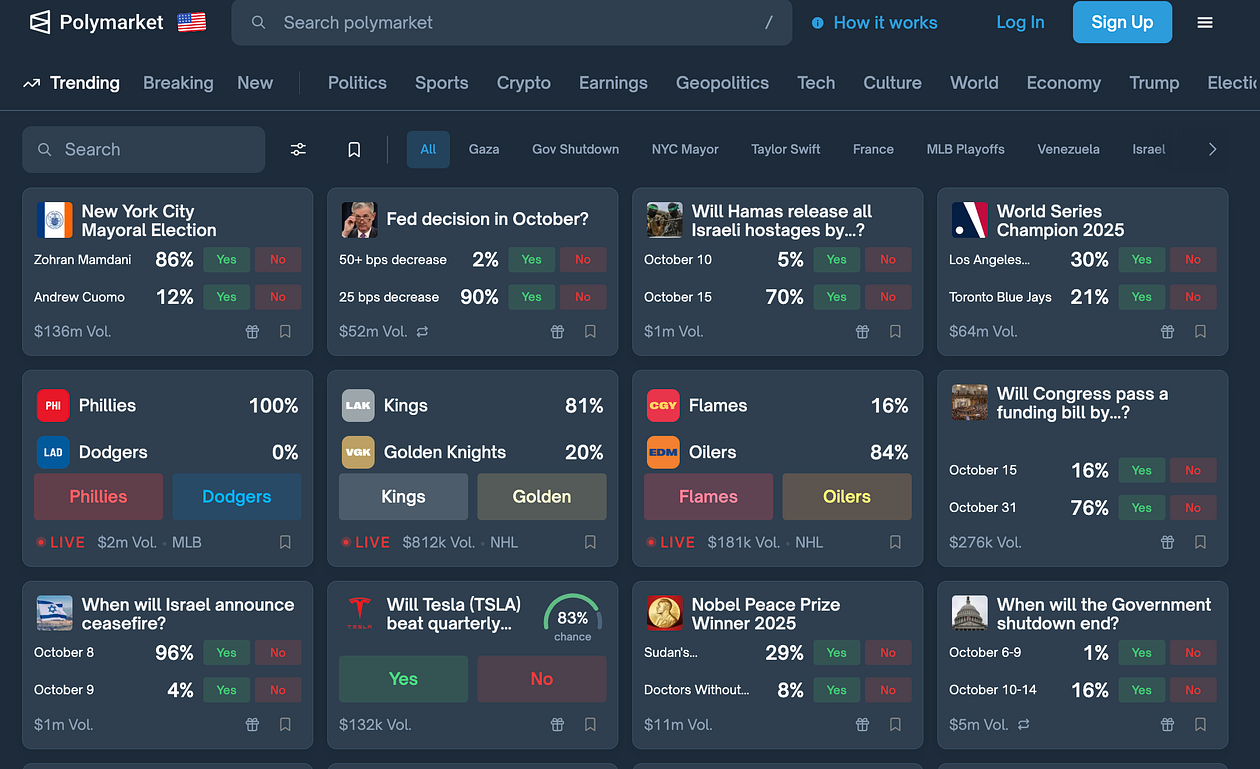

Image source: Backpack As we enter 2025, these platforms are no longer niche experiments but have rapidly expanded into a phenomenon worth billions of dollars, intertwining finance, technology, and human intuition. Take the 2024 U.S. election as an example: Polymarket's trading volume during the election exceeded $1 billion, with predictive accuracy far surpassing traditional polls. Now, in 2025, this market is expected to set new records, with nominal trading volume projected to reach $30 billion, achieving a 40% year-on-year growth compared to $16.3 billion in 2024.

Predicting the future is not a new concept that emerged in 2025. From the stock market pricing corporate prospects to insurance quantifying risks, human society has always been pricing the future. Prediction markets simply push this logic to the extreme: breaking down future events into contracts and allowing market prices to reflect the probability of occurrence. The real change occurs in 2025: on-chain transparent settlement, global no-threshold participation, socialized entry points, and the parallel development of compliant platforms transform prediction markets from a niche hobby into a track that capital, media, and institutions cannot ignore.

01|Understanding the Mechanism: Principles and Types

What is a Prediction Market?

A prediction market (also known as an information market, event derivative, etc.) is a trading platform where participants bet on the "yes/no" outcome of a future event or multiple options. After the contract expires, if the option you bought "occurs," you receive a fixed return (usually $1 per contract unit); otherwise, you lose your stake.

The core of trading is: contract price = the perceived probability of the event occurring --- --- the market continuously adjusts this probability through buying and selling actions.

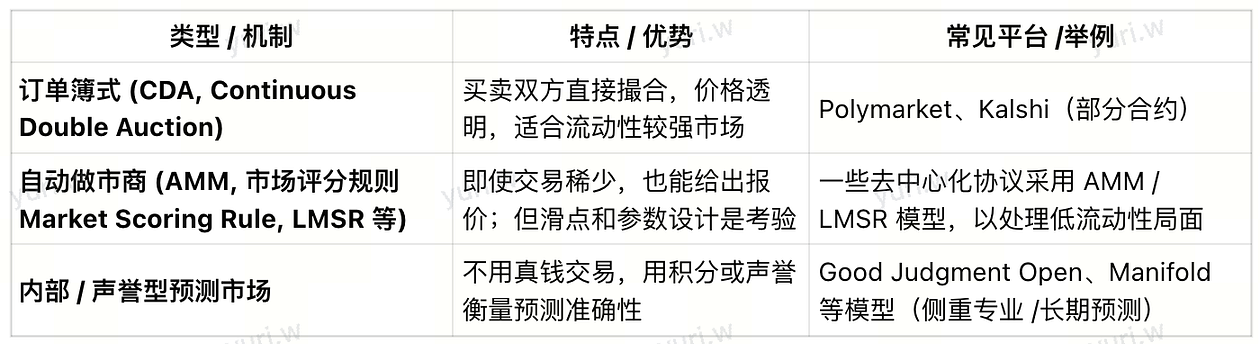

Types and Modeling Mechanisms

Prediction markets can have various architectures, with different designs determining their performance and limitations:

On the other hand, contract types are not always as simple as "binary (yes/no)": some contracts may have multiple options, while others are scalar (numerical range) types. The clearer and more verifiable the contract design, the more trust and liquidity it can gain from users.

Information Aggregation vs Operational Risks

The core value of prediction markets lies in "wisdom aggregation": each trader places bets based on their information judgment, thus the market price reflects the collective opinion. However, this also brings operational risks: manipulation by large players, bubbles, market biases, or opinion exhaustion (i.e., most people reading similar information) can distort prices.

02|Three Main Lines in 2025: Compliance Onboarding, Social Integration, Exchange-like Features

2.1 Compliance Onboarding: Kalshi Bridges Regulation and Distribution

- After a long tug-of-war with regulators, U.S. regulated election-related prediction contracts have been cleared by the courts, showcasing a compliance model effect; subsequently, Kalshi further integrated with Robinhood, embedding NFL and college football prediction entries directly into mainstream brokerage apps, significantly expanding reach.

- For a broader audience, "betting on real events like buying options" has become an understandable product paradigm, allowing prediction markets to transition from the crypto-native circle into a larger financial distribution network. Meanwhile, the narrative of federal regulation + cash settlement reinforces the perception of "safety and trustworthiness."

2.2 Decentralized Breakthrough: Polymarket's Scale and Influence

- Growth and Scale: During the 2024 election window, Polymarket's trading volume skyrocketed from $62 million in May to $2.1 billion in October (+3268%), and it has maintained monthly activity at the billion-dollar level in 2025.

- Attention and Citations: Mainstream media (CNN, Bloomberg, etc.) live-streamed and cited odds data, with traditional public opinion and on-chain data beginning to "track in parallel."

- Ecological Position: Currently, about 90% of funds are concentrated at both ends of Polymarket and Kalshi (decentralized/centralized bipolar), with the valuations and moats of leading platforms rapidly rising.

2.3 Social Integration and Experience Upgrade: From "Redirecting" to "Betting in Place"

- Content as Entry: Myriad, Flipr, and others embed betting interfaces directly into news feeds and social conversations (browse/discuss → one-click betting → return to discussion), minimizing friction from "information to trading."

- Exchange-like Penetration: Solana's Drift has added a BET prediction module to its derivatives terminal; TryLimitless on Base has redefined order matching experiences using on-chain CLOB (Central Limit Order Book); and Hyperliquid has proposed Event Perpetuals, addressing liquidity and slippage issues in binary markets through "continuous trading and one-time settlement at expiration."

Summary : Compliance and distribution attract incremental users, on-chain innovations enhance efficiency and playability, compressing the "content --- trading --- settlement" link, and prediction markets evolve from a single application form to a product matrix with multiple entry points in parallel .

03|Popular Application Scenarios

- Sports Prediction: NFL and new season events drive a new wave of enthusiasm, with contracts covering game outcomes, player statistics, and even real-time events, often achieving higher predictive accuracy than experts.

- Crypto and DeFi: Companies and investors use prediction markets to hedge against regulatory and macro risks, while RWA tokenization brings stocks and real estate into on-chain predictions, and privacy technologies like FHE enhance compliance.

- AI Empowerment: AI models act as virtual traders in the market, learning and predicting in real-time, even providing automated betting services.

- National Security: U.S. intelligence agencies are studying the incorporation of prediction markets into threat analysis, with topics like the South China Sea situation and sanctions policies becoming reference signal sources.

04|Major Prediction Market Platforms

- Polymarket: Decentralized leader, expected to exceed $35 billion in total trading volume in 2025.

- Kalshi: Compliance representative, connected to Robinhood, focusing on elections, macroeconomic, and financial events.

- PredictIt: An academically-backed platform, strong in political predictions but with lower betting limits.

- Emerging Players: TryLimitless (Base chain) optimizes trading with CLOB, Talus Labs explores AI-driven predictions, and Noasight is a prediction market on the Sui chain, with active ecological innovations.

Source: Rootdata

Source: Rootdata

05|Product and Mechanism Design: From AMM to CLOB, and Then to Information Perpetuals

- AMM Binary Pools: Suitable for quickly creating and long-tail markets, but prone to price jumps and liquidity drying up as settlement approaches.

- CLOB (On-chain Order Book): Friendly to market making and high-frequency trading, with depth and price discovery closer to traditional exchange logic. TryLimitless uses CLOB to handle multi-outcome/multi-leg positions, locking in profits and losses in advance, making the experience more like "event options."

- Information Perpetuals (Event Perps): Introduces continuous trading curves, with settlement anchoring at 0/1 at once, eliminating the need for high-frequency price feeds during the period, turning "news and probabilities" into a tradable time series; this path aims to accommodate larger speculative and hedging demands.

- Oracles and Arbitration: The credibility of recorded outcomes is fundamental. Mainstream on-chain platforms often use third-party oracles + dispute arbitration, but the transparency of arbitration boundaries and processes directly determines the platform's credibility (see §05 Risks).

06|Participation and Monetization: From "Betting Direction" to "Formulating Strategies"

If you view prediction markets merely as "betting on who wins," that's just the entry point. The real play lies in treating it as a synthetic options and information exchange, establishing systematic strategies around "pricing deviations --- information lags --- structural incentives."

- Cross-Platform Arbitrage: When the implied probabilities of the same event differ across CEX/compliant platforms/on-chain platforms, buy low and sell high for risk-free expectations; this can be semi-automated with APIs.

- Become an AMM LP: Earn fees in high-traffic markets, using "delta-neutral" positions to hedge directional exposure and capture liquidity premiums.

- Bayesian Updates vs Market Lags: Establish an "event --- probability" update model, adjusting positions before the public reacts, capturing the information --- execution time difference.

- Odds --- Asset Linkage: Use predictive odds to guide on-chain/centralized derivatives (e.g., trading linked to BTC/ETH perpetuals), positioning before "announcements."

- Combos and Conditional Bets (Parlays/Multi-leg): Link "primaries --- general elections" and "data releases --- asset trends" to create path-dependent risk/reward structures.

Risk Control Tip : Use simplified Kelly or fixed proportions for budget allocation; do not exceed 1-3% of total funds in a single market; prioritize locking in profits as settlement approaches instead of "betting on the outcome."

07|Facing the Dark Side: Oracles, Manipulation, Regulation, and Ethics

Oracles and Dispute Resolution

On-chain settlement heavily relies on oracles for "external truth." Over the past year, some markets with exceptionally large capital volumes have encountered disputes over result interpretation and arbitration processes: for example, differences in understanding news wording or judgment criteria led to market determinations that contradicted the intuition of most participants, with users accusing the results of being "biased towards large holders." Such events directly erode platform trust and compel upgrades in predictability of rules and transparency of appeal processes.

Manipulation and "Reflexivity"

Prediction markets can inversely shape events: when market outcomes influence public opinion and behavior, large funds can create narratives and influence information sources, thereby affecting judgments and prices. Design solutions include: multi-source oracles, delayed settlement windows, clear/machine-readable condition descriptions, and redesigning incentives and penalties for arbitrators.

Regulation and Regional Differences

Centralized compliance paths and decentralized freedom paths will coexist in the long term. Regulated cash settlement platforms offer stronger compliance and consumer protection, while decentralized platforms excel in global reach, censorship resistance, and innovation speed. The two sides will mutually elevate the industry's ceiling.

Ethical Dilemmas: Betting on war, disaster, and similar events raises social controversies.

08|From "Applications" to "Infrastructure": Where Are We Heading?

- Distribution Layer: Deep integration of compliant platforms and brokerage apps, combined with social/content-native entry points, transforms prediction from a "destination" into an "ongoing action."

- Matching Layer: CLOB and information perpetuals elevate the event trading experience and capacity to "exchange-level," accommodating larger leverage, more complex combinations, and broader topics.

- Ecological Layer: Capital and liquidity are highly concentrated towards leading bipolar platforms (Polymarket × Kalshi), while surrounding front-end, bots, data indices, and market-making tools are emerging rapidly, evolving the industry from "single-platform competition" to a "multi-role collaborative network."

Conclusion

Prediction markets are not a panacea, but they can price uncertainty and aggregate dispersed information into probabilities. They serve as risk hedging tools for investors, decision aids for institutions, and a "probability window" for the public to glimpse the future.

In the future, the path of prediction markets is becoming clearer:

- Parallel Compliance and Decentralization: Integrating into the mainstream financial system while maintaining on-chain innovation.

- Fusion of AI and Automation: AI trading agents and data models joining the market to enhance efficiency and precision.

- Social Distribution: Embedding betting interfaces from news to social applications, making prediction markets a default module.

- Infrastructure Development: Expanding from entertainment and elections to economic data, corporate strategy, energy, and healthcare.

By 2025, prediction markets are no longer niche experiments but have taken center stage in finance and crypto. The next question is: Will you choose to stand as an observer, or will you bet on the future?