From TORN to MKR to COMP, the DeFi leaders have finally rolled into the economic model

Source: Odaily Planet Daily

In the past two days, two quiet events have occurred in the DeFi space that may significantly impact the future development of the two leading projects, Maker and Compound.

On March 14 and 15, governance proposals were submitted in the forums of Maker and Compound, aiming to completely overhaul the token economic models of these two major projects.

Maker: From MKR to stkMKR

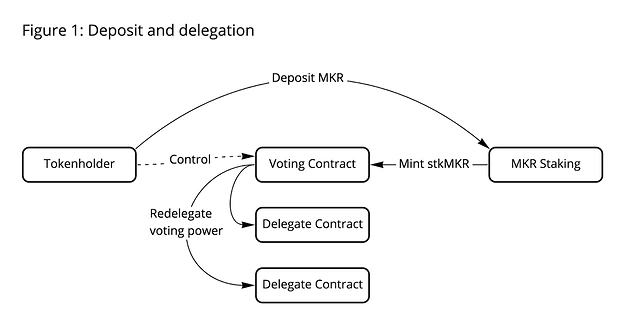

First, let's talk about Maker. This proposal was put forward by risk control team member monetsupply.eth, drawing on design logic from Cosmos, stkAAVE, and xSUSHI. The core content aims to replace MKR with stkMKR as Maker's direct governance token. Specifically:

First, users can stake MKR in the governance protocol to obtain stkMKR. stkMKR is non-transferable and represents the user's voting rights and the right to redeem the staked MKR shares.

Second, the previous MKR buyback and burn mechanism will be abandoned. The MKR bought back will no longer be burned but will flow linearly into a yield pool as the yield from staked MKR. This means that the amount of MKR corresponding to each unit of stkMKR will gradually increase, logically similar to the automatic compounding mechanism of xSUSHI.

Third, similar to Cosmos and stkAAVE, users will need to wait for a fixed lock-up period when they unstake MKR. During this period, stkMKR will be burned, and the corresponding MKR will be transferred to a custody contract, meaning that users will not enjoy any yield or voting rights during this phase. Only after the lock-up period ends can users redeem their MKR, although users can also change their minds during the lock-up period and immediately restake their MKR to exchange for stkMKR.

monetsupply.eth explained that the detailed changes in these economic models are expected to achieve the following effects:

First, it can incentivize the level of governance participation. Although this mechanism will not directly incentivize users' voting behavior, the potential yield from staking MKR is expected to improve the overall participation rate of the community.

Second, it improves the appreciation narrative of MKR. Compared to the buyback and burn model, more specific APR figures and a reduction in circulating supply can help improve overall market sentiment. monetsupply.eth also roughly estimated the yield figures: when 50% of MKR is staked, the yield of stkMKR is about 3.25%, and when 20% of MKR is staked, the yield of stkMKR is about 5.5%.

Third, it enhances governance security. The staking yield objectively reduces the attractiveness of borrowing MKR, and the existence of a lock-up period can effectively prevent governance attacks and increase their execution costs, while also curbing participation from centralized service providers that may undermine the decentralization of MakerDAO.

Fourth, it improves resistance to credit deficiencies in the protocol. During market crashes or reorganizations, the existence of a lock-up period can keep some MKR away from the market, preventing some MKR holders from rushing to conduct debt auctions.

Compound: Goodbye, liquidity mining

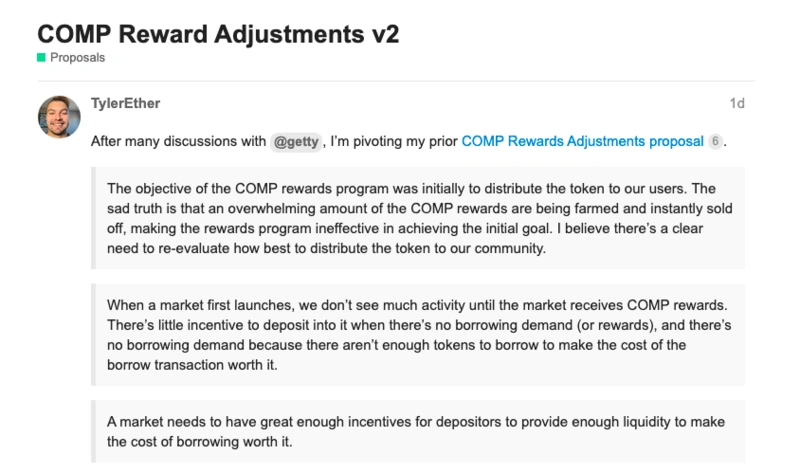

The Compound improvement proposal was put forward by community contributor tylerether.eth, with the core content being to gradually stop the current liquidity token incentives and switch to an interest rate incentive model.

Friends familiar with the history of DeFi development may remember that in the summer of 2020, Compound innovatively launched a liquidity mining program, which unexpectedly triggered countless projects to follow suit, thus sparking the recent DeFi boom.

However, in tylerether.eth's view, the liquidity incentive measures that Compound relied on to gain momentum are currently attracting more "speculative" liquidity, which often chooses to sell immediately after receiving the corresponding COMP incentives. This is contrary to Compound's original intention—"to distribute COMP to real users"—and dilutes the COMP earnings that real users should receive, harming community interests.

However, a lack of incentive measures is also undesirable for the lending market, as this could lead to insufficient liquidity in the market, thereby suppressing the overall market's operational effectiveness, especially when a new market (i.e., a new token) is launched.

To address this, tylerether.eth proposed his improvement plan. Specifically:

First, the current COMP incentives will be phased out in two steps: first, on March 18, the on-chain incentives will be reduced to 50%, and then on April 15, the incentives will be completely reduced to zero.

Second, further improvements to the interest rate model are needed, as the existing jump rate model and parameters, while well-suited for the stablecoin market, may not necessarily apply to the non-stablecoin market. Under the current suboptimal interest rate model, it is difficult to balance the interests of both borrowers and lenders, thus limiting the scale of market liquidity.

Third, an alternative incentive plan will be introduced. Once the interest rate model upgrade is completed, Compound will need to launch a new incentive plan to kickstart the lending market for new tokens, which can also be used for existing markets with insufficient liquidity. tylerether.eth mentioned some design ideas for this new incentive plan—providing Y% annual interest rate incentives for a new market for a period of n months.

However, this incentive will be limited to a target scale of X, for example, providing an 8% annual interest rate incentive for the COMP deposit pool for one year, but this 8% will only apply to $10 million of liquidity in the pool, while the remaining liquidity's interest rate will still be determined by market supply and demand.

Lack of business innovation, optimizing economic models?

It is important to emphasize that the two proposals put forward by monetsupply.eth and tylerether.eth are still in the governance process, and it is uncertain whether they will pass and take effect, especially the latter. Personally, while I appreciate the attempt, I still find it difficult to implement in the short term.

In contrast, monetsupply.eth's proposal in the Maker community is clearer and has ample precedent to reference. In contrast, tylerether.eth's proposal for Compound lacks detail in areas such as interest rate model improvements and new incentive plan parameter settings. Additionally, the move to stop liquidity incentives is too radical, which undoubtedly touches on the interests of multiple roles within the ecosystem, and the impact on the future development of the protocol still needs careful assessment.

Objectively speaking, compared to Curve, the economic models of Maker and Compound do seem somewhat simplistic, which gives the two leading protocols room for improvement, allowing adjustments to their economic models to enhance the investment sentiment and market conditions of their tokens.

Reflecting on the previous case of Tornado.cash quickly achieving a "take-off" in the secondary market after upgrading the TORN economic model, this attempt by Maker and Compound is certainly not wrong for the protocols themselves.

However, from my personal perspective, watching one established DeFi project after another shift their focus to economic models is somewhat bittersweet. While the design of an economic model is indeed important for the comprehensive development of a project, I personally still place more value on innovations in business logic and product functionality. These innovations determine the fundamentals of the project's business and its outward expansion capabilities, whereas changes in economic models feel more like internal optimizations.

Indeed, DeFi is not at its best right now; we haven't seen enough stunning new ideas for some time. Looking back at the leading DeFi projects in the market, most were actually born in the last cycle. While we remain steadfast in our belief in the future of DeFi, perhaps the market needs some time to nurture new seeds.