Chairman of the Solana Foundation: Everything can be tokenized, and Solana strives to become the future financial infrastructure

Content organized by: Jinse Finance

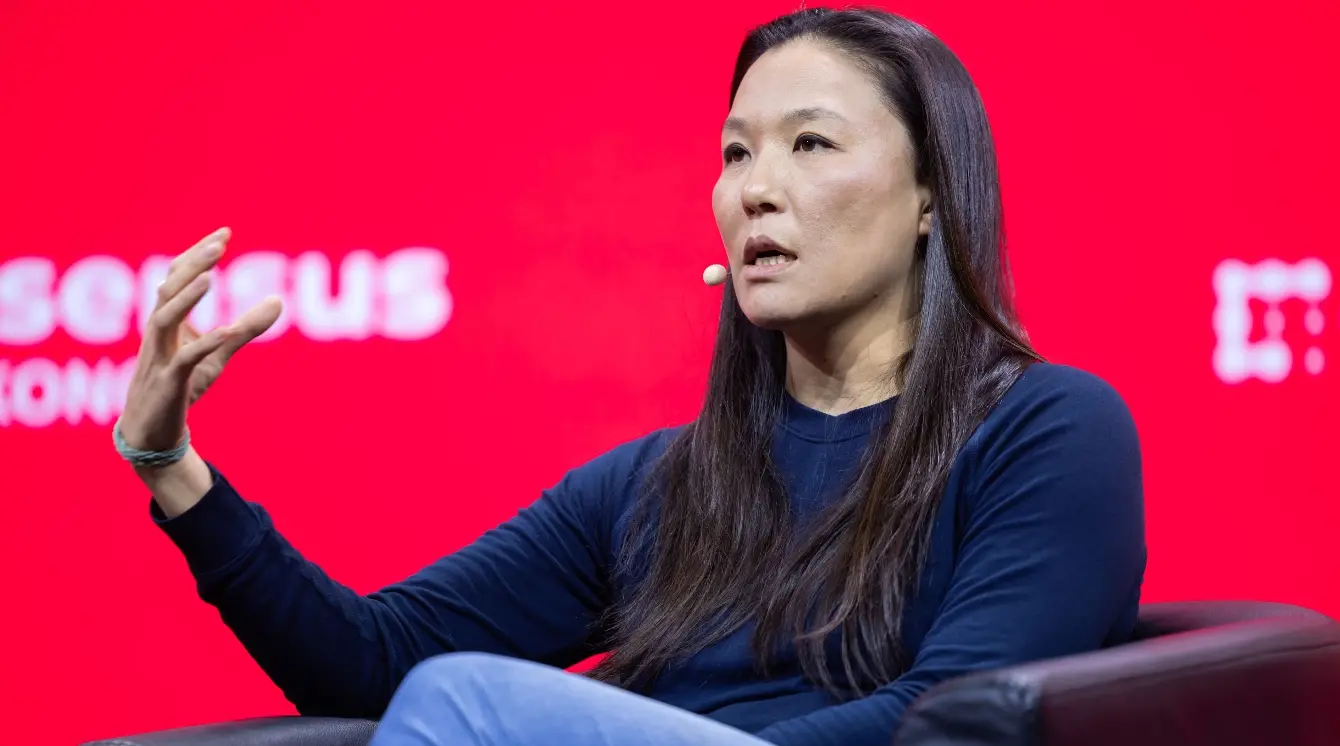

From October 18 to October 22, the 2025 Shanghai Blockchain International Week and the 11th Global Blockchain Summit will be held in Shanghai. Lily Liu, Chair of the Solana Foundation, delivered a keynote speech at the event. Lily Liu stated that every generation of internet advancement and innovation will have specific hardware and software requirements. The essence of blockchain is, first, assets, and second, financial infrastructure. Solana aims to build a technological platform for internet finance, serving as the foundational infrastructure for internet finance.

Regarding Solana's current development situation, Lily Liu mentioned that Solana ranks first in application revenue across the industry, has the highest growth rate in the developer community, and leads in newly issued assets. She believes that all assets will become digital assets, "everything can be tokenized." Solana's vision is to achieve the tokenization of all assets, including blockchain-native assets, traditional financial assets, and emerging assets, transforming these asset classes into tradable, usable, and collateralizable assets.

When discussing the development of Solana in the Chinese-speaking region, Lily Liu stated that Solana has always placed great importance on this area and has made significant investments over the past two years to support the developer ecosystem. Solana will continue to support the developer community in the domestic Chinese-speaking region and hopes for more collaboration in payments, DePIN, and AI sectors.

Lily Liu emphasized that the future of the crypto industry will have two main application scenarios: one is assets, and the other is international financial facilities. Bitcoin, as "digital gold," will continue to serve as a primary asset, while Solana strives to become the future financial infrastructure.

Jinse Finance organizes Lily Liu's speech as follows.

Host: Next, let's welcome Lily Liu, Chair of the Solana Foundation, to deliver the keynote speech. Please give her a warm welcome! Welcome, Lily!

Lily Liu: Good morning! I am Lily Liu, my Chinese name is Liu Yuanli.

Actually, I first heard about Bitcoin when I was living in Shanghai back in 2013. Today is my first opportunity to return to Shanghai and participate in a blockchain conference here, so I am very grateful to Mr. Xiao, who has been supporting the development of the entire industry domestically for the past ten years. I also appreciate the opportunity to collaborate with HashKey and other partners to support the ecosystem and share Solana's recent progress, future plans, and development direction in Shanghai.

How many of you have heard of Solana? Please raise your hands. Quite a few! Our community in China is also very active.

First, let me explain why I became interested in Bitcoin back in 2013 in Shanghai. I had a classmate named Huabili (phonetic), who kept bringing up Bitcoin since August 2013, insisting that I should look into it. We often played poker together, and he kept talking about Bitcoin. I thought it seemed like Huabili's religious belief in Bitcoin. I decided to read the white paper, as I was initially skeptical about the technology being real.

When I opened the white paper, it stated "A Peer-to-Peer Electronic Cash System." I began to think this was actually a very interesting concept. The internet now is an information internet. 2014 also marked the second wave of internet development, which could be described as a mobile internet. Each generation of internet advancement and innovation will have specific hardware and software requirements.

Why do we call it Web3? Because Web3 is related to assets and new developments and innovations in the internet, and it has its own set of hardware and software. What is the main use of blockchain itself? There are two primary uses: first, blockchain as an asset, and by 2025, it is clear which chain plays that role—Bitcoin. However, Bitcoin's own white paper is titled "peer to peer electronic cash system," not "digital gold." Bitcoin gives us the vision of whether it is possible to build a native financial infrastructure for the internet. Blockchain is, on one hand, an asset, and on the other hand, it dreams of being a financial infrastructure. I was looking at what technologies around me could go in that direction.

I remember the discussions about Bitcoin's Block Size in 2016 and 2017 lasted for several years. Ultimately, Bitcoin decided to be an asset, but which technology would serve as the platform to form the financial infrastructure of the internet?

Now, let's talk about some of the problems faced by traditional finance. Of course, traditional finance is already a rich system and a very diverse market. However, what we have come to accept as a common reality is that there are so many assets and markets, but they are all fragmented. How are they fragmented? Different countries, different banks, different enterprises, different standards. Now it has become that each country, each company, and each consortium has its own standard. However, money and assets will enjoy the theory of "network effects." What is the concept? A network with more users and more people using it will increase in value.

We have all seen the "Experience Economy" (phonetic) on the internet. Network effects are incredibly strong, large, and important. We often say "money is work business." The network effects we have seen in some application platforms have a very strong impact, and finance will also have a significant impact.

Speaking of Solana, what was the initial vision? It was to provide technology services for finance, to be a technological platform for internet finance, and to serve as the foundational infrastructure for internet finance. How do we describe it? We need to integrate all asset classes and all use cases in a mobile environment; that is Solana.

Now, let’s discuss Solana's promotion of the internet capital market. The ecosystem has three layers: the first is the network, the second is the application platform and technology platform, and the third is the asset layer. For the ecosystem to develop, each layer must be active, and it is crucial that each layer can also generate revenue.

Let me share some current data. Solana has developed very rapidly over the past few years. In terms of Solana's usage, the daily usage is 2-3 times that of all other chains in the industry combined. Applications on Solana are very profitable; currently, Solana's applications rank first in application revenue across the industry. The developer community is the core of each community, and the growth rate of developers has accelerated significantly over the past few years. Since last year, Solana has ranked first in developer community growth rate. Integrating all assets and markets together, Solana also ranks first in newly issued assets.

Specifically, in the first quarter of 2025, the Solana ecosystem began to experience very rapid growth across the network layer, application layer, and asset layer.

Solana is a scalable blockchain that integrates all users, applications, assets, and use cases in one environment. Typically, our industry compares the performance of this chain to that of another. Our vision is to exceed the performance of traditional finance. This year marks the fifth anniversary of our mainnet launch, and we can achieve over 1000 TPS daily, excluding voting TPS. In comparison, Visa achieves 1700 TPS, meaning we are already close to the performance of two leading traditional financial platforms, Visa and Nasdaq. We can achieve comparable performance with large networks and enterprises.

At the network layer, we emphasize continuously improving bandwidth and reducing latency. This year and next year, we will have many technological advancements. Currently, it takes 400 milliseconds to complete a block, and transaction fees are only 0.0005 per minute, which is already leading performance in the blockchain space. However, we are not satisfied. If we truly want to establish a native internet financial infrastructure, we need to advance on the technical and network levels.

What kind of use cases are we aiming for? We believe all assets will become digital assets, "everything can be tokenized." Traditional finance currently has a scale of 500 trillion in assets, but only a small portion has been brought onto the chain in the past year, generally through Money Market Funds. Initially, we did not believe that blockchain infrastructure would only serve one ecosystem's assets or only serve blockchain-native assets. Currently, the volume of blockchain-native assets is about 4 trillion. Some recent events may have slightly reduced this number, but the blockchain is now facing a small range of assets, which should be the industry's goal.

If we tokenize all assets, where will these assets be used? We believe in "the marketization of everything." Our vision is to tokenize all assets, including blockchain-native assets, traditional financial assets, and entirely new assets. For example, gaming assets like Pokémon cards are a popular market that can also be tokenized and transformed into tradable, usable, and collateralizable assets on the blockchain.

If we compare Solana to these financial companies, taking some examples from Europe and America, Solana has only five years of development time, with approximately 80 million active users each month. In comparison, our partner PayPal, which has been developing for 30 years, has about 400 million monthly users. We hope to reach such a scale without waiting 30 years.

Let me first discuss the progress and data of the developer community. It is crucial to attract new developers. A community has two main resources: talent and capital. This requirement is the same for any economy, company, or entity. In 2024, we attracted 7,500 new developers, and developers in the Solana ecosystem have also received significant economic benefits. In 2024, ecosystem application revenue reached 3.3 billion dollars, and fundraising reached 8.9 billion dollars. In fact, Solana itself only raised 30 million, which is a small part of that number.

Currently, there are over 2,000 applications in the ecosystem, and the newly launched Solana Seeker mobile application has already surpassed 100 applications. Not only developers are participating in our ecosystem, but many enterprises are also joining, especially now focusing on stablecoins and other use cases to enter the Solana ecosystem.

We are currently the fastest-growing platform. Why does Solana place great importance on the Chinese-speaking region? Because we start with payments. If we only talk about payments, especially in the domestic Chinese-speaking region, we are leading in this area. With a population of 1 billion, who created the concept of "Super APP" in the past 15 years? It was created domestically, and the domestic payment ecosystem is very unique.

What does Solana hope to achieve in the Chinese-speaking region? Over the past two years, we have made significant investments to support the developer ecosystem in this area. We will continue to support the developer community here, especially hoping for more collaboration in payments, DePIN, and AI sectors.

In the future, Solana can be compared to Netflix in entertainment and Amazon in e-commerce. Using this comparison, we can say that Solana reached a market value of 100 billion dollars the fastest, taking only four and a half years, while Apple took 30 years, and Google took 8 years. If we consider the time from the mainnet to now, it has only been 5 years to achieve such progress, and we believe the next five years are also very promising. What do we rely on? We rely on our network's revenue. The development of the ecosystem depends on the network generating income and helping our application developers make money, which is essential for forming a stable and sustainable economic system.

Our industry has two reasons for use: one is assets, and the other is international financial facilities. We believe Bitcoin, as "digital gold," serves as an asset, while the future financial infrastructure will be Solana.

Thank you very much!