How to Get Through the Bitcoin Winter? Investment Strategies, Advice, and Bottom Assessment

Author: Dyme

Compiled by: Shenchao TechFlow

Currently, it seems that the crypto market is undergoing a significant "rule change." The previous market frenzy was exciting, but the reality is that the real challenges are just beginning.

Wait.

All current signs indicate that Bitcoin is in "risk-off" mode, and the echoes of the 2021 market are resurfacing: Bitcoin surged significantly before the stock market peaked, while the stock market has not performed well in recent months.

As of the time of writing, Bitcoin's price has dropped about 30% compared to its historical high. We reached the anticipated market peak in early October. Some people successfully sold or took profits above $100,000 (well done!), but now the inevitable question looms: "What happens next?"

Unlike in April of this year, I am not in a rush to establish a long-term position (although I currently hold a long position, aiming for a rebound to the $95,000 to $100,000 range).

I know many readers consider Bitcoin as their core asset and may also dabble in some altcoin trading. You might be wondering: "Where is the bottom?" or "When should I buy?"

The correct answer is that no one can be completely certain. However, there are many strategies that can help you maximize returns while ensuring you don't miss the next wave. My goal is to provide you with some insights to help you form your own market judgment and understand when the market rules might change again. I am a "left-brained" trader and do not delve into complex data like order books.

I am an expert in "market sentiment" and a proponent of data simplification. Here are my shared experiences.

First, the core assumption of this article is that Bitcoin will reach new historical highs and that market cycles remain valid. Based on all current information and market reactions, we should consider this a realistic foundation.

This article also acknowledges that Bitcoin is an excellent savings technology for patient investors, while for those lacking patience or over-leveraging, it can be a "wealth destruction" tool.

The discussion will focus on Bitcoin, because frankly, over the past 36 months, apart from Solana and some short-term speculative hotspots, 90% of your altcoins have performed poorly. We have 1 to 2 years to wait for new altcoin narratives to form, at which point you can decide whether to bet on these opportunities.

Next, we will explore the following aspects:

- Investment strategies

- Cyclical expectations and timing

- Where to park funds during the waiting period

- Key indicators for market bottoms

Investment Strategies

When I mention "strategies," I refer to your attitude and approach to buying, selling, and holding. In this market, there are various ways to enter and exit, and the final choice is yours.

Your strategy ultimately hinges on one question: "Do you have confidence in timing the market accurately?" and can you execute your market judgment? If not, what other viable options do you have?

Currently, there are several time-tested Bitcoin investment methods, with HODLing (holding on for dear life) being the most popular.

HODLing is one of the earliest investment tenets in the Bitcoin community. If you are confident in Bitcoin's long-term prospects and your daily currency needs are met, this strategy may be very appealing to you.

Moreover, HODLing is also a highly tax-efficient investment method because as long as you don't sell, you won't incur taxes.

Some investors can endure an 80% drawdown in their portfolios and tactically increase their positions during each market downturn. If your fiat needs are met and you can hold for years, this method can almost guarantee intergenerational wealth accumulation over a sufficiently long time.

This strategy is particularly suitable for those who wish to grow their wealth over time and gradually increase their Bitcoin holdings. Of course, this approach requires a high level of patience; some people can do it, while others cannot. But if you are patient enough, it is indeed feasible.

Sticking to HODLing was my starting point when I entered this space, but clearly, my strategy has evolved over time.

The Dollar Cost Averaging (DCA) strategy aligns closely with the HODL philosophy but is not limited to it. Some people buy Bitcoin daily regardless of the price; others choose to buy weekly, monthly, or during market fluctuations.

Goals of Dollar Cost Averaging

- Continuously increase your Bitcoin holdings while minimizing upward pressure on the average cost;

- If you previously bought at high prices, you can lower your cost basis through DCA.

For example, I bought Bitcoin at the peak in 2013 and then continued to DCA until the price dropped to $200. Ultimately, this strategy proved successful.

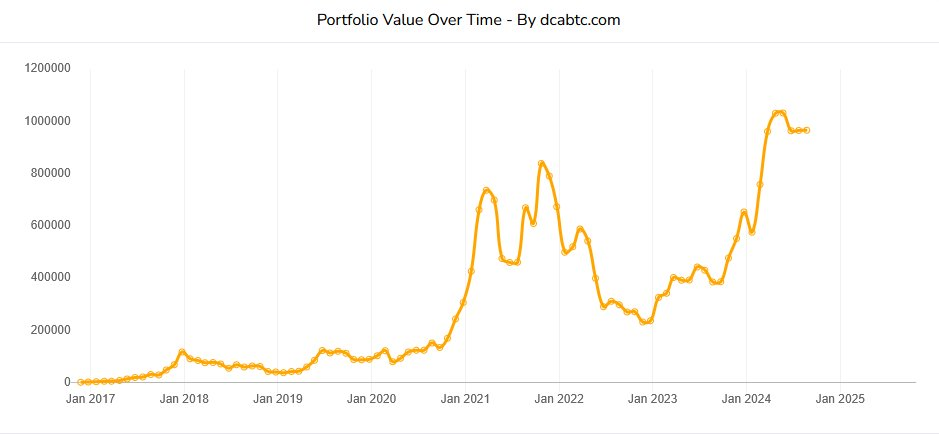

Image: Investing $1,000 monthly reaches a peak of $1 million after 9 years

The above image illustrates a typical DCA (Dollar-Cost Averaging) case. Although this result is clearly derived from hindsight, it clearly shows that investors who consistently purchased Bitcoin regularly, even during this month's market pullback, still achieved wealth growth without incurring any taxes.

If you have a certain understanding of the market, adjusting the timing of your DCA strategy can significantly amplify your unrealized fiat gains.

Of course, you don't need to invest in a completely mechanical way; nowadays, you have more options. But for those who want to "set it and forget it," there are some simple tools to help achieve this goal.

Platforms like Coinbase, Cash App, and Strike offer automatic purchase options, which you can turn on or off as needed. However, these services each have different trade-offs, fees, and limitations, so it's advisable to conduct thorough research before setting them up. Especially regarding fees, if you run automatic purchases for months or even years, the fees can accumulate into a significant expense.

You can set up a low-frequency small plan or a short-term large-scale aggressive plan. If you are good at timing the market and believe the bottom is coming but don't know when, I would lean towards the latter.

You can also skip third-party platforms and manually DCA. Place orders on your preferred exchange when you think Bitcoin is "on sale," or even set laddered buy orders based on your market analysis and technical indicators. It all depends on your personal preference.

Whether automated or manual, as long as you maintain a certain consistency, the end result will be the same.

The core idea behind DCA is that "time in the market" beats "trying to time the market," and data usually supports this view.

Whether through HODLing or DCA, you can flexibly adjust the scale based on your financial situation. The market may drop deeper than expected or hit the bottom faster than anticipated, so finding a balance that suits you is particularly important.

Not everyone can fit neatly into the HODL or DCA framework. Many investors prefer a hybrid strategy that lies between the two:

- You are not trying to time the market perfectly, but you also won't buy blindly.

- Your buying decisions are based on liquidity conditions, spikes in volatility, or moments when market sentiment completely collapses.

This method is an effective strategy that often outperforms the extremes of the two approaches because it respects both patience and opportunity. It can be seen as rule-based accumulation rather than mere blind guessing.

Another rarely discussed angle is the choice between a lump-sum purchase and phased entry.

From a purely expected return perspective, lump-sum purchases often outperform in a long-term upward trending market. However, most people cannot bear the emotional shock of a one-time "all-in."

Phased entry can reduce regret and make the entire investment process easier to stick with. If you have a significant amount of cash on hand, using part of it for an initial purchase and gradually investing the remaining funds in stages is a more realistic choice for the average investor.

You need to take your liquidity discipline seriously. One of the biggest reasons people are forced to sell is that they mix daily operating funds, emergency savings, and Bitcoin investments into the same "mental account."

When life inevitably brings you financial surprises, Bitcoin may become an "ATM" you never thought of. To avoid this situation, please allocate cash for different purposes so that you don't have to sell assets in vulnerable or desperate moments. This alone is a competitive advantage.

In addition, your investment strategy needs to have a sense of proportion. People do not "get liquidated" because Bitcoin drops; rather, they:

- Emotionally increased their positions;

- Turned to altcoins (Alts) chasing short-term thrills;

- Used leverage in an attempt to "make back losses."

The harshest penalties in a bear market often target overconfident investors. Maintain rationality in your positions, be wary of narratives that "sound good," and always stay grounded.

Bitcoin Cycles and Timing: Will Cycles Shorten?

I have discussed Bitcoin's "cyclicality" multiple times, but what is slightly concerning now is that it seems everyone is well aware of these cycles. So, will this cycle shorten? I don't know.

For those unfamiliar, here's a brief overview:

Bitcoin, for better or worse, is a time-based cyclical asset, and its rises and falls are closely related to the halving cycles.

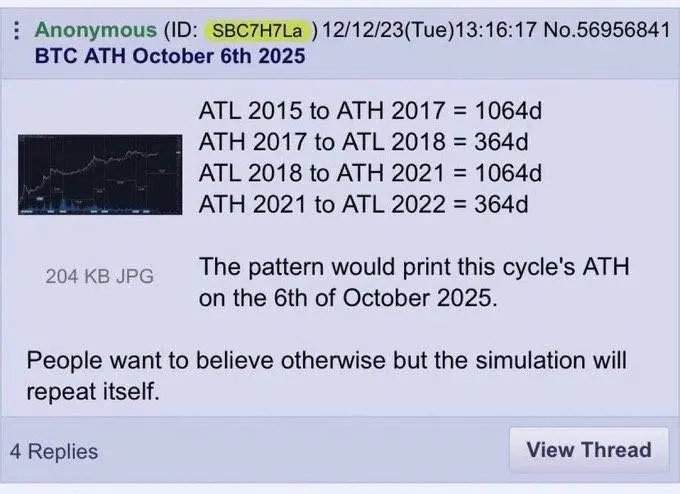

So far, Bitcoin's price movements still follow these cyclical patterns. As previously mentioned, we should temporarily assume that this regularity will continue. If the cycle continues to operate, we might see a macro bottom in early Q4 2026.

However, this does not mean you should wait until the first day of Q4 2026 to start buying; rather, it provides a reference that suggests it may still be too early to buy now. Of course, the cycle may have already ended, and the bottom could arrive as early as this summer, at which point other technical analysis (TA) and signals will need to be reconsidered.

Overall, I do not believe Bitcoin will return to a long-term bull market before the end of 2026 or 2027. Of course, if I am wrong, I would be happy to see it.

Where Should Funds Be Parked While Waiting for Market Opportunities?

As interest rates continue to decline, "safe but boring" yields are becoming less attractive. However, we still have a few months to enjoy yields above 3% before Federal Reserve Chairman Jerome Powell "takes action." Here are some options to consider for those who have withdrawn some funds from the market and are waiting for the right moment. Please be sure to do your own research on these options.

SGOV and WEEK offer the simplest monthly and weekly dividend options, holding boring but stable government bonds.

Other options include ultra-short-term government bond ETFs like SHV and pure short-term bond funds, or slightly longer-duration bond ETFs like ICSH or ULST. SHV provides exposure almost identical to SGOV, as it holds very short-term government bonds, performing like a cash substitute but with a slight yield enhancement.

WEEK also belongs to the same category but is structured for weekly distributions, suitable for investors needing more frequent cash flow. However, the trade-off is that weekly distributions may fluctuate with interest rate changes.

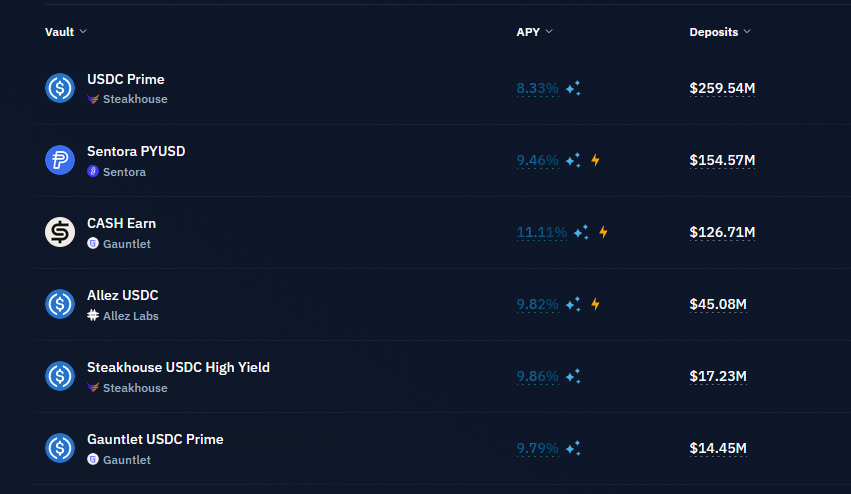

If you are familiar with on-chain operations, despite the decline in DeFi yields, there are still some options available:

AAVE

- Currently, AAVE offers about 3.2% yield on USDT.

Kamino

- Kamino provides higher-risk but higher-return options, with yields typically exceeding "risk-free" rates, but also comes with additional risk factors.

It is important to note that while these on-chain platforms are optional, they are not suitable for full allocation. If you choose the DeFi route, it is advisable to diversify your investments to mitigate risk.

Image: The higher the yield, the greater the risk

Many exchanges (like Coinbase) will offer you rewards for parking USDC on their platform. Robinhood can also provide a yield of 3%-4% if you have a Gold membership.

In a downward economic trend, you don't need to overthink; the goal is very clear: protect purchasing power while combating inflation.

How to Determine Market Bottoms?

Assuming it is nine months from now, and the market has faced multiple adverse factors, perhaps Bitcoin's price is nearing $50,000. In this case, how can you determine if we are close to the bottom?

It is important to note that market bottoms are never determined by a single signal. Forming an investment logic (THESIS WITH CONFLUENCE) through the following indicators can help you enter the market with more confidence and wait for returns.

1. Time

How long has it been since the historical high (ATH)? If it has been over 9 months, it may be time to start considering buying.

2. Momentum

Bitcoin typically peaks when momentum wanes, and vice versa. Buying Bitcoin when the weekly RSI (Relative Strength Index) is below 40 is often a good choice.

Zooming out, combine your commonly used momentum indicator scripts to find an analysis method that suits you.

3. Market Sentiment

Cycles are often accompanied by certain catastrophic events that trigger extremely uneasy market sentiment. For example, the FTX collapse, the outbreak of the pandemic, the Terra Luna incident, etc.

When the market is shrouded in dark moments, and no one wants to buy Bitcoin, it is precisely your opportunity to act boldly, especially when you can get resonance from multiple signal sources.

For example, at the bottom of the last cycle, we saw an unknown influencer promoting mattresses. If you bought Bitcoin at that time, you would likely be very satisfied now.

4. You Don't Have to Buy at the Bottom

You don't need to be fixated on buying at the market's lowest point. If you want to be more cautious, you can wait for Bitcoin to regain the 50-week exponential moving average (50W EMA) or the 365-day volume-weighted average price (VWAP), both of which are excellent confirmation signals.

5. Bitcoin's Risk Preference Indicator (Beta)

If Bitcoin-related stocks like MSTR (MicroStrategy) regain the 200-day simple moving average (SMA), it may indicate a return of market interest and premium for Bitcoin.

My goal is to help some people lock in profits at the market top, and I hope this article can help you prepare for the future.

Disclaimer: This article is for informational sharing and educational purposes only and does not constitute any financial, investment, or legal advice. Please be sure to conduct your own research and consult licensed professionals before making any financial decisions. The market carries risks, and investments should be approached with caution. Remember, "There are no tears in the casino."